The U.S. Deficit Dilemma

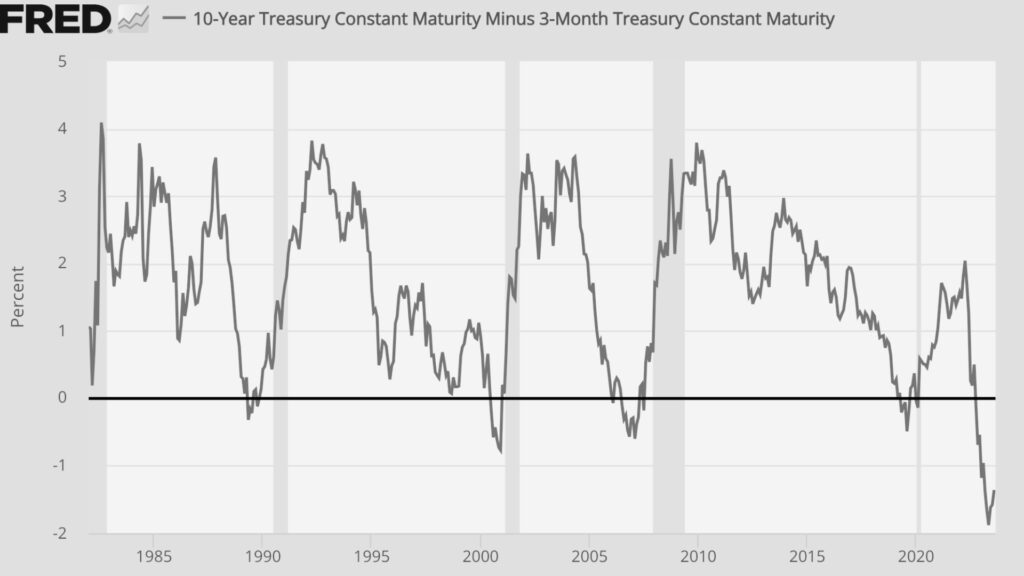

America currently grapples with an annual deficit of nine percent of GDP, an historically high figure. A significant portion of this deficit is attributed to the mounting interest costs on the national debt. Interest rates have surged from near-zero levels at the start of the previous year to over five and a quarter percent today. Falling tax receipts exacerbate the situation, leading to reduced income and increased spending on debt interest. To further complicate matters, a series of recent events during the weeks preceding the initial publishing of this interview have challenged the mood and expectations of global markets:

- 20% increase in oil prices from their lows.

- Bank of Japan’s yield curve control on Japanese Government Bonds

- U.S. credit rating downgrade

- The U.S. Treasury’s announcement to borrow nearly $1.9 trillion in Q2 of 2023.

The Strong Dollar Problem

A central issue at hand is the tug-of-war between the Federal Reserve (the Fed) and the U.S. Treasury. They are both aligned in desiring a strong dollar, primarily to support the bond market. However, this approach may no longer align with America’s geopolitical ambitions, particularly as it relates to China, Russia, and lingering discussions of a BRICS currency.

Balancing Act: Inflation and Cost of Living

The U.S. government faces a delicate balancing act between two key economic policies that seem to be at odds. The persisting deficit spending has delivered inflationary consequences that are driving US prices up, while driving the value of the US dollar down.

This interview suggests that the spending stems from the mounting debt that the US government has accumulated in pursuit of achieving geopolitical goals, reassuring domestic production capacity, and responding to the concerns of the American citizens since the pandemic in 2019.

Fiscal and Monetary Policy Mismatch

This increase in spending by the US government has been met with increased interest rates from the US central bank to offset the rising inflation created by the US deficit spending.

The Fed’s focus on low inflation at the same time that the US government increasing debt spending has put the central bank’s monetary policy at odds with Biden administration’s fiscal policy. This discordance raises concerns about the long-term consequences and effectiveness of both policies. Luke Groman clearly suggests that the Federal Reserve’s commitment to curbing inflation is curious, given that key economies in Europe and possible China are slipping into recession.

Warning of a Sovereign Debt Crisis

Luke Gromen cites several several prominent analysts that have been vocal about the looming sovereign debt crisis in the U.S. and other major nations. The culmination of these factors suggests an impending crisis that could have far-reaching consequences.

The Timing of Economic Interventions

One pressing question is the timing of potential economic interventions in response to this crisis. While the exact timeline remains uncertain, some indicators suggest that actions may be required sooner rather than later. Treasury buybacks are expected in 2024, potentially impacting liquidity. The Federal Reserve may be compelled to revisit quantitative easing and interest rate cuts to address the mounting challenges.

Risky Business

The financial landscape is in a state of silent, tectonic flux, with multiple variables all repositioning at once. Mr. Gromen suggests that understanding the true nature of these cross-currents is critical to understanding which impacts will prevail in the long term, and which will collapse under pressure. These monetary and fiscal policy decision will have profound, long-lasting consequences for all the politicians, investors, and even regular citizens involved.

Let’s hope they know what they’re doing.